iowa capital gains tax on property

How CGT affects real estate including rental properties land improvements and your home. Gains from the sale of stocks or bonds DO NOT qualify for the deduction with the following exception.

Capital Gains Tax Iowa Landowner Options

For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction.

. Its a federal tax thats paid to the IRS. Capital GAINS Tax. You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of property thats not your home for example.

Property and capital gains tax. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly.

IA 100 was designed to collect key information up-front rather. Commercial real estate is a capital asset which. In some cases you might be able to use a capital loss to reduce your income.

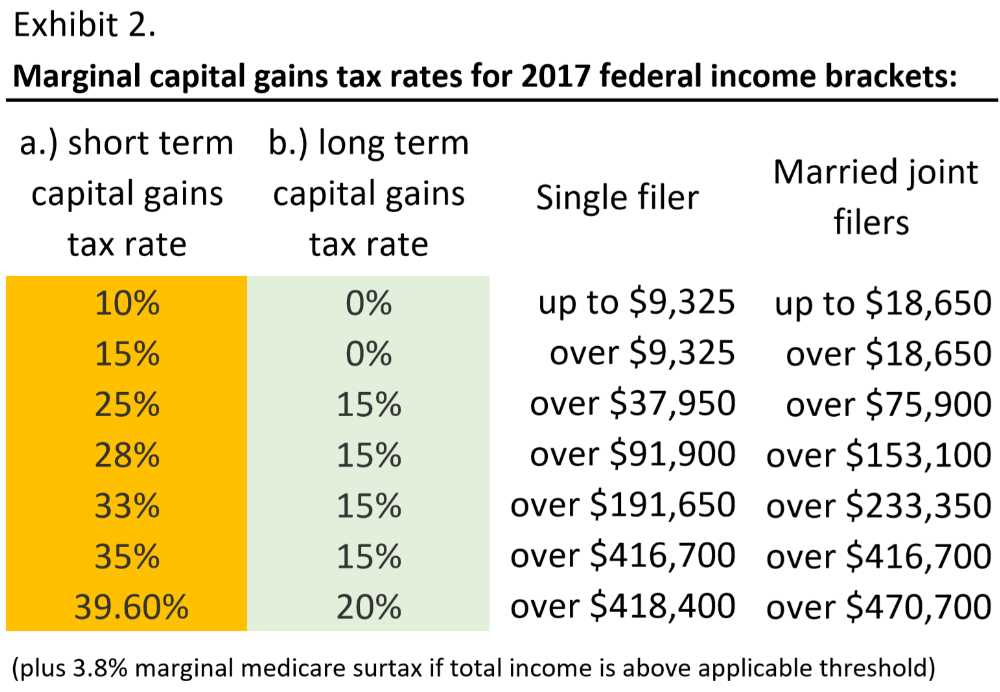

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. See Tax Case Study. Effective with tax year 2012 50 of the gain from the saleexchange of employer.

Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898. The 15 rate applies to individual earners between 40401 and. Iowa is a somewhat different story.

IA 100A - IA 100F Capital Gain Deduction Information. When a landowner dies the basis is automatically reset. A gain sometimes referred to as a gain on sale is the difference between the sales price of a property and its cost basis.

A capital loss occurs when you sell a property for less money than you originally purchased it for. So in Feenstras example the son or daughter wouldnt have to pay taxes. First the administration wanted to impose the capital gains tax only when the heir sold the property.

Toll Free 8773731031 Fax 8777797427. How are capital gains taxed in Iowa. To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C.

In real estate capital gains tax is the tax you pay on a capital gain made when you sell a property. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state.

Includes short and long-term Federal and State Capital. Last year the Iowa Department of Revenue unveiled a new form for claiming the Iowa Capital Gain Deduction. All publicly distributed Iowa tax forms can be found on the Iowa Department of Revenues tax form index site.

Short-term capital gains are taxed as ordinary income according to federal. The most basic of the qualifying elements for the deduction requires the ability to count to 10 or. To claim a deduction for capital gains from the qualifying sale.

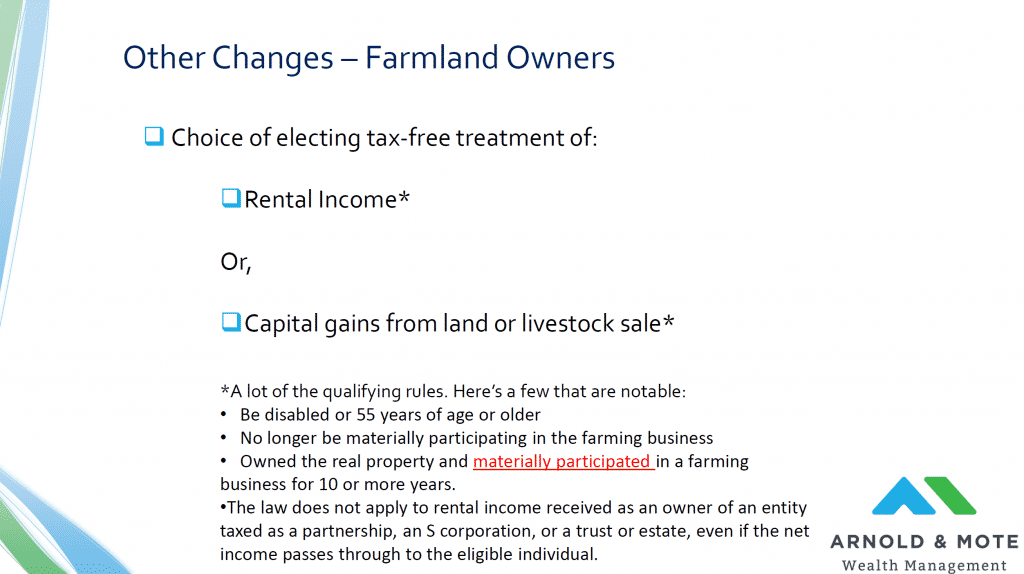

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Long-term capital gains tax rate. Iowa tax law provides for a 100 percent deduction for qualifying capital gains.

For example lets say you purchased a. Browse them all here. Which records to keep for your property so you can work out.

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Iowa Landowner Options

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

The Ultimate Guide To Iowa Real Estate Taxes Clever Real Estate

Real Estate Capital Gains Tax Rates In 2021 2022

How Will Iowa S New Tax Law Affect Retired Farmers Iowa Capital Dispatch

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

1031 Exchange Iowa Capital Gains Tax Rate 2022

State Taxes On Capital Gains Center On Budget And Policy Priorities

Avoiding Capital Gains Taxes When Selling A House Smartasset

Can You Avoid Capital Gains Tax In Nebraska Element Homebuyers

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Capital Gains Full Report Tax Policy Center

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

Capital Gains Full Report Tax Policy Center

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit